Asset Impact has expanded its asset-based dataset to include key sub-sectors of the chemical industry – methanol and ammonia production – providing banks with a critical new forward-looking dataset for managing climate-related transition risk.

Key figures

- 1253 companies (253 listed and 1000 unlisted)

- 701 ammonia and/or methanol production sites

- Accounting for ~96% of direct emissions from ammonia and methanol production (2022)

The chemical sector is the largest industrial energy consumer globally and the third-highest industrial emitter of direct CO₂, according to the IEA. Despite this, it remains underrepresented in portfolio-level climate disclosures and target-setting frameworks.

Asset Impact’s new dataset helps to address this gap by offering granular, asset-level emissions and company structure data. Initial coverage 103% of global ammonia production (2022) and 114% of methanol production (2024), benchmarked against MPP and GPCA data, respectively. It captures emissions of CO₂, CH₄, and N₂O and identifies the use of carbon capture technologies where applicable.

The dataset is designed to support financed emissions calculations, portfolio screening, and transition plan assessments. It is updated biannually for assets and quarterly for company structure. Derived from BlueQuark Research and Consulting, the IEA, and other databases, the dataset is forward-compatible with emerging regulatory standards and enables banks to prepare for potential inclusion of the sector in voluntary and supervisory frameworks.

"Global demand for chemicals is rising with these products deeply embedded in almost every major value chain, from energy and agriculture to manufacturing and consumer goods. This makes the sector both economically critical and a major lever for decarbonizing the broader industrial sector. Our new indicators help banks understand their exposure, support credible engagement, and drive action where it can have systemic impact." — Vincent Jerosch-Herold, CPO, Asset Impact

Insights to impact

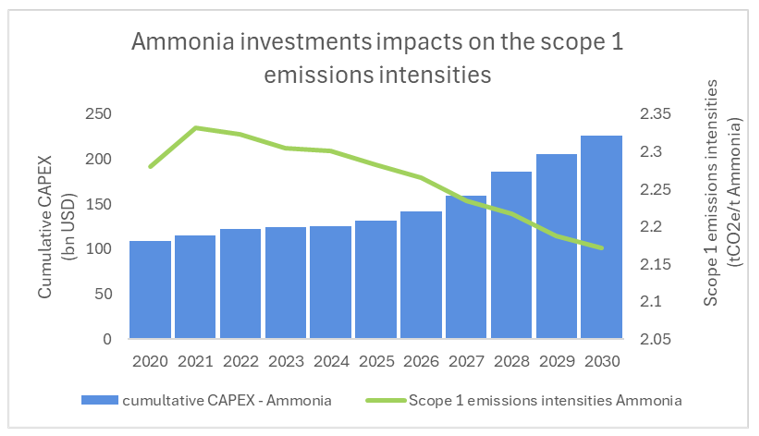

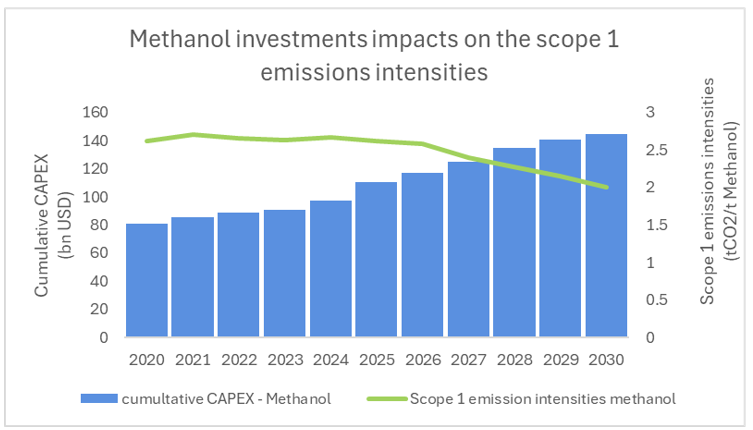

In the chemicals sector, companies are looking forward, with investments continuing to grow in the coming years to improve their environmental performance.

The increase in investments is already showing results — weighted emissions intensities are beginning to decline, as illustrated in the charts below.

Let's talk

Looking for more details on using our forward-looking asset-based data? Our team is here to support you.

Contact us